Economic predictions affect local commercial property market

October 2025After a recent presentation from Glynn Jones, Deputy Agent for the Bank of England, this article talks about how the economic predictions are affecting local commercial property in Worcestershire.

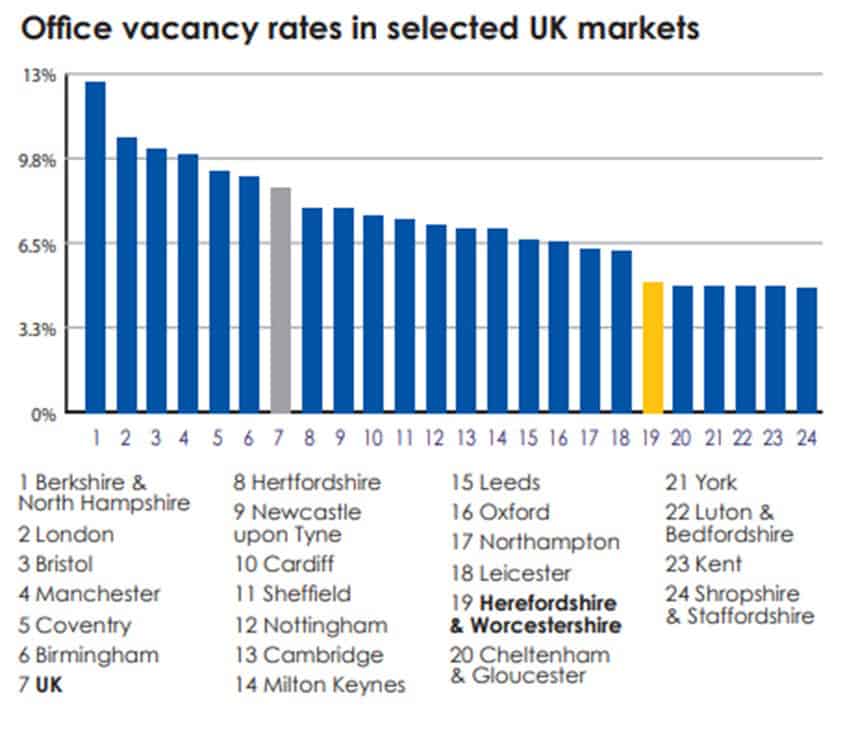

Nationally office vacancy rates across the UK continued to climb last year, this being amid a fifth straight year of negative net absorption, meaning more space was vacated than occupied.

However, the office sector is polarised, with prime modern space being favoured over older stock, with net absorption in the best quality buildings remaining positive and all the demand losses occurring in buildings rated four stars or below. Across the UK, and here in Worcestershire, firms are seeking top quality space to attract and retain staff, welcome clients, and to meet growing environmental commitments.

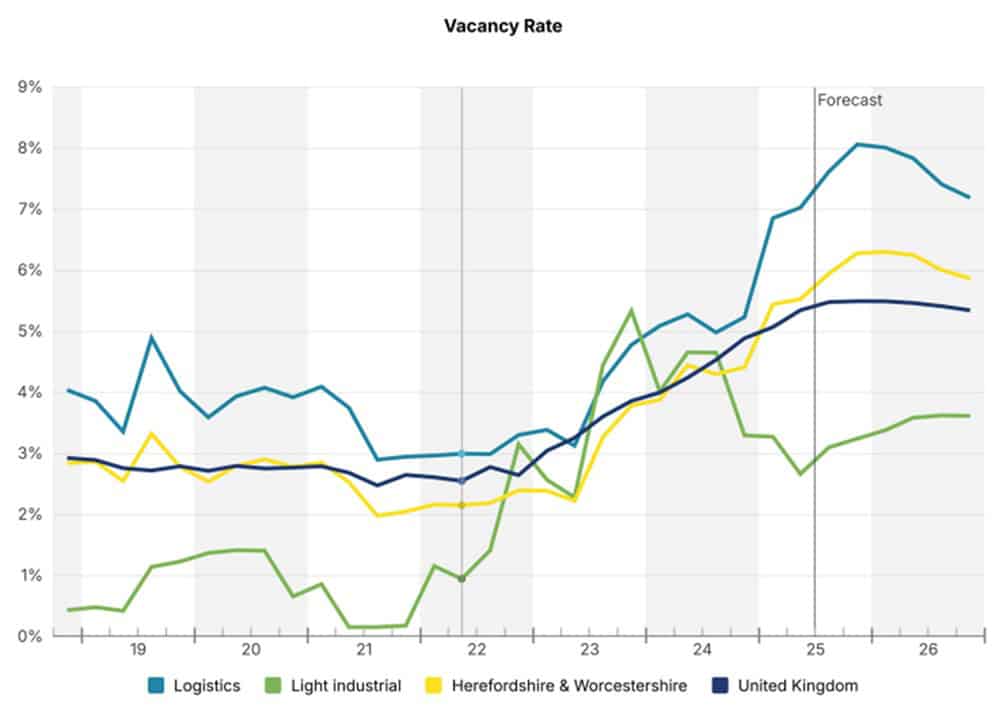

The graph above shows Herefordshire and Worcestershire sitting well within the national picture. Only five regional markets have a lower vacancy rate and the current rate of 4.2% is half the national average of 8.8% – although as I’ll mention in a minute, this is still sitting close to a decade high.

A concern within the county is that whilst part of this low vacancy rate performance is attributed to market activity, it is predominantly driven by a lack of development and delivery of quality schemes to the market. Within the smaller county towns owners have converted empty office buildings into alternative uses such as residential, resulting in a loss of office stock on a net basis in recent years.

This trend will likely continue, especially as new energy regulations will make many office buildings unlettable in the coming years. This could bring down vacancy rates even without much demand.

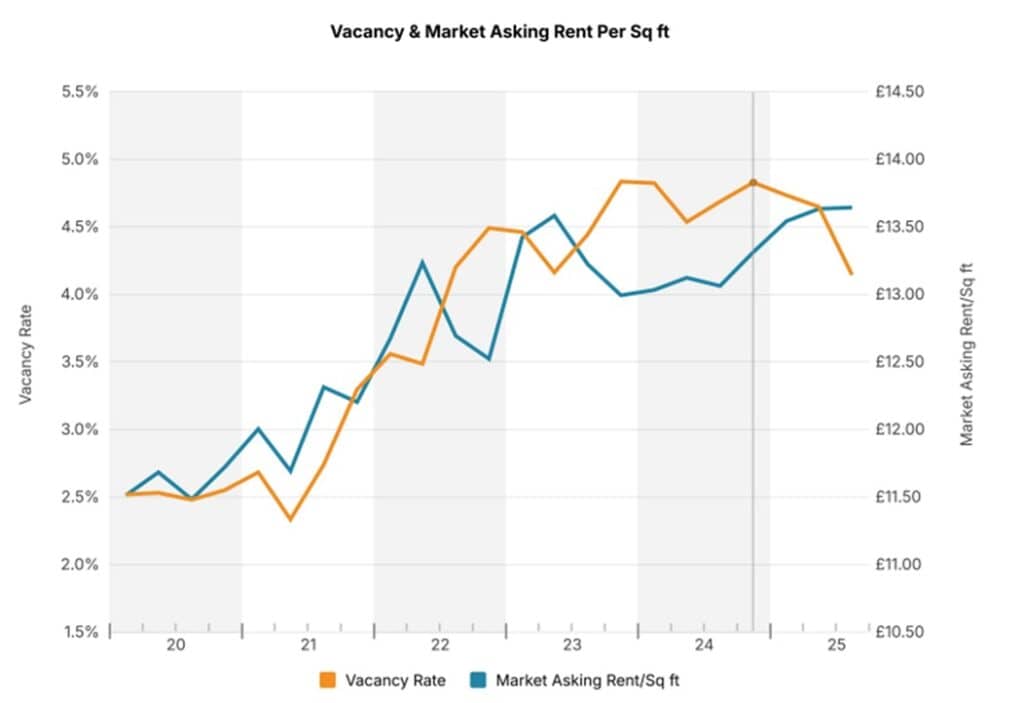

Office market conditions in Worcestershire have stabilised in 2025, in line with higher office attendance and companies having more clarity over their space needs as the pandemic disappears in the rearview mirror. As already touched on one factor that could hinder tenant demand going forward is the market’s lack of quality stock. Worcestershire has around 200,000 sq ft of higher quality inventory, equivalent to around 2% of the markets 10 million sq ft.

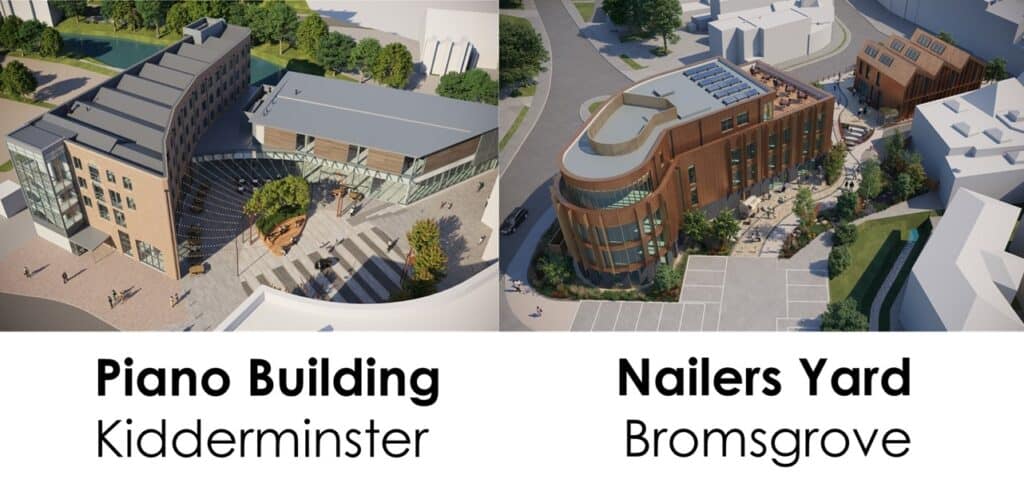

There are however key schemes in the pipeline including Wyre Forest District Councils Levelling Up Fund-backed redevelopment of the Piano Building in Kidderminster, which includes office space alongside entertainment and restaurant accommodation and set to deliver 30,000 sq ft of mixed-use space imminently.

Nailers Yard is another mixed-use scheme, this time in Bromsgrove and delivered by Bromsgrove District Council, that will add 12,000 sq ft of office space alongside restaurant space early next year.

Worcester and it’s surrounds has the biggest pipeline of proposed space with around 200,000 sq ft across the new business parks, though none of these are likely to move forward without pre-lets.

Refurbishments have pushed rents higher in recent times, though the pace of rental growth has eased recently to 4.4% year-over-year, down from 6% a couple of years ago. This partly reflects elevated vacancy levels and tenants’ higher cost bases, particularly following April’s rise in employer national insurance contributions and Living Wage increases. Our forecast over the coming years indicates average office rental growth to remain muted, though the market’s better-quality buildings remain suitably placed to outperform.

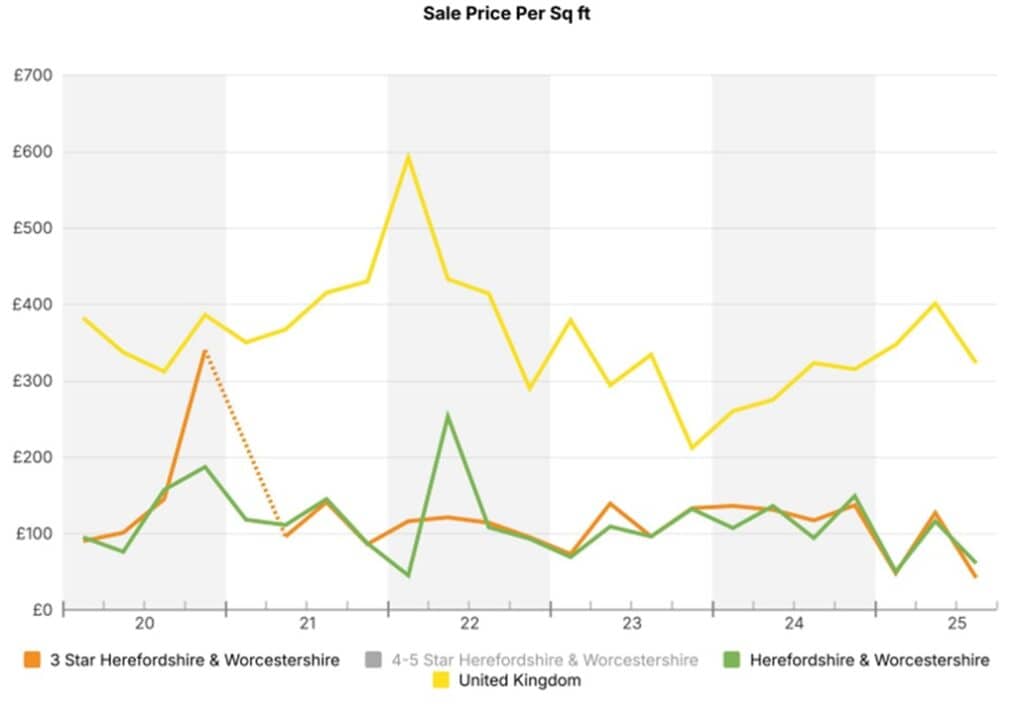

Office investment activity in Worcestershire has been trending downwards amid still high interest rates and weak investor appetite for non-core office markets. Buyers have deployed £8.9 million over the past 12 months, which compares to £14.1 million a year earlier and a 10-year average of £19.3 million.

The chart above shows how the regional market of Herefordshire & Worcestershire is well below the national average when looking at sales rates per sq ft. This again is reflective of the quality of the stock and the lack of returns offered by the lettings market. Whilst we may never compete with the major city office markets in terms of the quality of space, what would be encouraging to see is a gradual increase in sales rates, thus encouraging investment into the area and improving our office space offering to businesses currently in the region and those looking to relocate here.

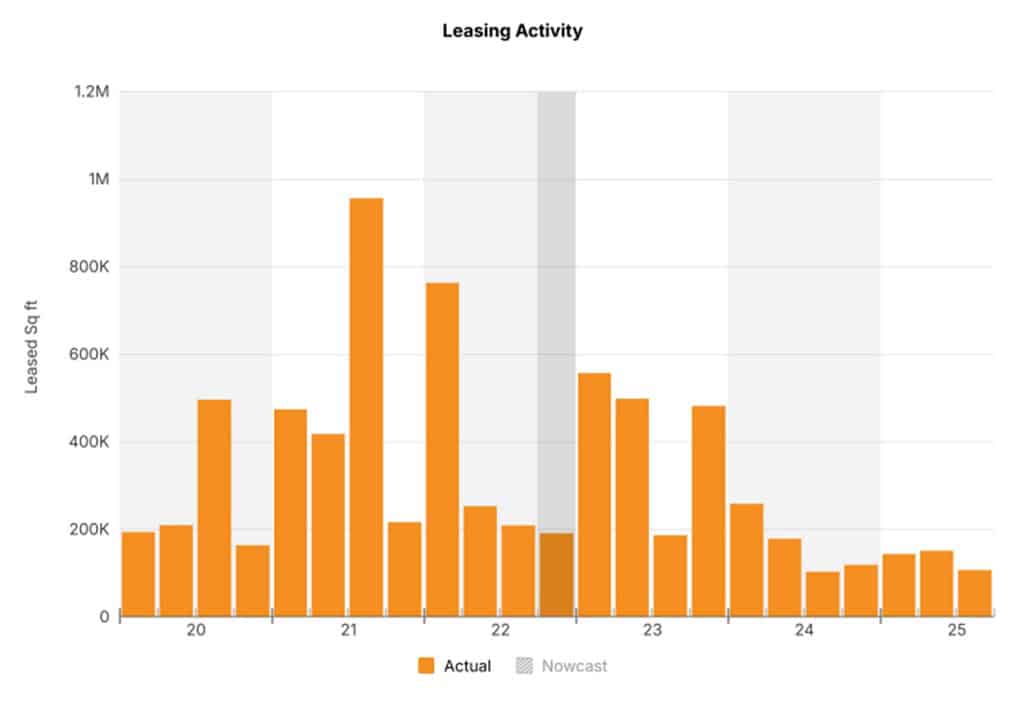

Occupier demand for industrial property across the UK continued to normalise over the past 12 months as elevated interest rates and weaker business conditions weighed on take-up and net absorption. The latter metric turned negative last year as larger warehouse occupiers, principally third-party logistic companies and retailers scaled back their property footprints.

Still, the sector continues to benefit from structural factors such as e-commerce, supply chain reconfiguration and the push towards net-zero carbon emissions, which should continue to support leasing decisions and, in turn, unlock opportunities for investors.

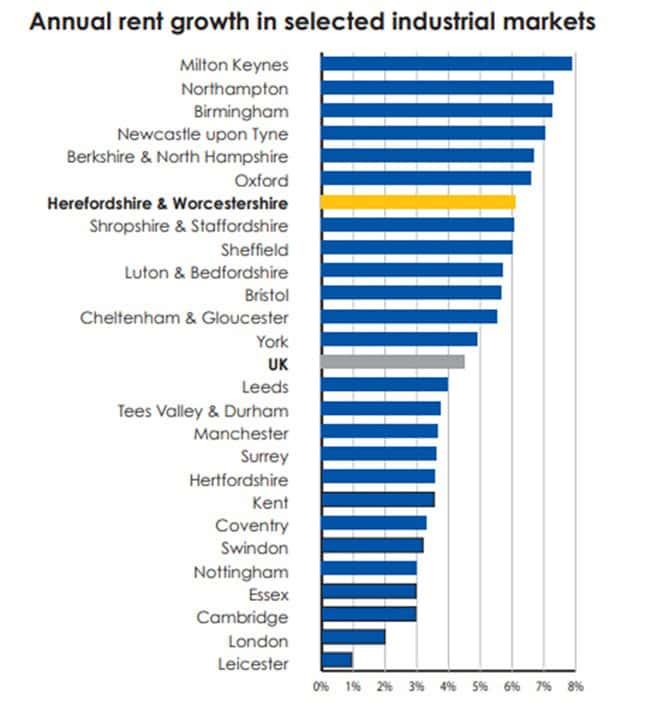

Herefordshire & Worcestershire’s sub-5.5% availability rate makes it one of the tightest major industrial markets in the country. The market has outperformed the UK for rental growth over the past three years as a result, though the pace of expansion has cooled a bit in recent quarters. Bromsgrove, Worcester and Redditch have been particular hotspots, with rents in the submarkets rising by nearly 7% in 2024. The national growth rate was 4.5%.

Industrial market conditions in Worcestershire have softened in recent quarters. Vacancies have risen, albeit from a low base, as demand has cooled and supply has increased. Some occupiers remain cautious amid economic uncertainty and inflationary pressures, though we are seeing an uptick in enquiry levels, something that certainly started in Q1/Q2 2025, perhaps slowed over the summer months but is very much being felt this last month and into the autumn.

In keeping with the picture across the UK, tenant-controlled availability has risen after companies took on too much space during the height of the pandemic. For example, we are aware of a third part fulfilment and logistics operator that is looking to assign its lease on a recently built 120,000 sq ft warehouse, as they simply took on too much space nationally back at a time when supply chains were disrupted.

Although industrial vacancies here are expected to remain elevated in the near- to medium-term, a lack of speculative development is likely to keep a lid on the vacancy rate. Occupier demand is expected to pick up from 2026 as stronger economic growth and improving business confidence feed into demand for new facilities.

Worcestershire’s latest speculative supply wave is coming to an end, which should help to cushion the impact of reduced demand on the market’s vacancy rate. Around 540,000 sq. ft is under construction, equivalent to 0.9% of existing stock and down from early 2023 when over 800,000 sq ft was underway.

Although speculative construction starts have fallen away in recent months, reflecting high build and financing costs and weaker occupier market conditions, several notable schemes have reached completion. Among them is Droitwich 170, a 170,000-sq ft, BREEAM Excellent-rated logistics warehouse developed by Harwood.

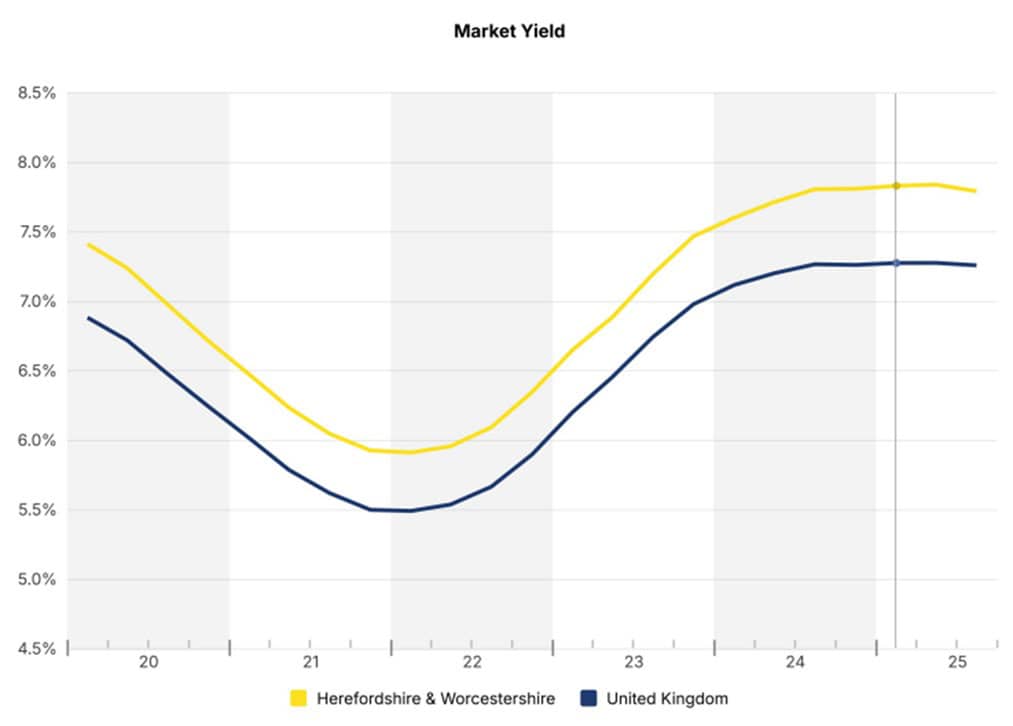

Annual industrial investment volumes in Worcestershire remain well below their pandemic peak. Higher interest rates and a lack of willing or forced sellers continue to weigh on transaction volumes, with investors have deployed £60 million over the past 12 months, compared to £168 million in the prior 12 months and a five-year annual average of £145 million.

In terms of pricing, average industrial yields across Worcestershire have moved outwards since early 2022 to 7.8%, reflecting interest rate rises. Average yields may have room to compress a little over the coming quarters in light of some of the positives we heard from The Bank of England presentation.

To summarise our local Worcestershire commercial property market, it certainly is a challenging period, more due to market stagnation than consolidation. However, there are positives and there are local businesses who are looking to grow. It is those businesses that have a plan to better their property offering that will make the most out of the opportunities that out there.

Data and analysis sourced from CoStar.

For further information on commercial property in Worcestershire, please contact GJS Dillon on 01905 676169 or click here to view our 2025 Market Research Report.

Return to News