Regional knowledge and commercial expertise, with you at every stage.

For over 15 years, GJS Dillon has supported the business community across Worcestershire with clear, practical commercial property advice. As a proactive, director-led firm of Chartered Surveyors, we combine unrivalled local market knowledge with an uncompromising personal service. Taking the time to understand your situation and guide you to the right solution so that you can make confident property decisions at every stage.

Find your perfect commercial property in Worcestershire

Our Services

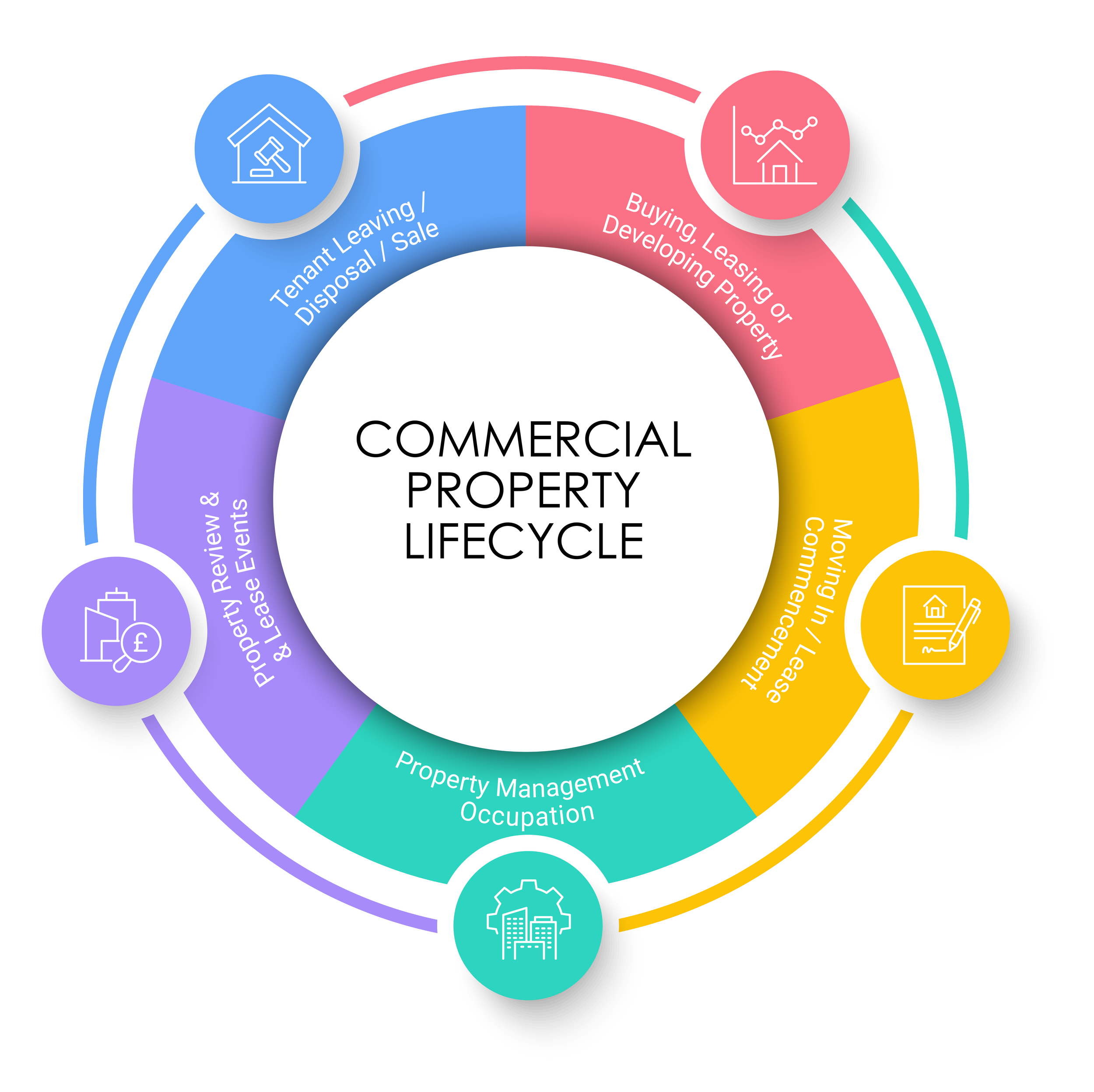

Commercial property support at every stage

Whether you’re acquiring premises, managing an existing asset or dealing with a lease or compliance issue, our in-house team provides joined-up advice across the entire commercial property lifecycle.

-

Sales, Lettings & Acquisitions

Helping owners, occupiers and investors buy, sell or lease commercial property with confidence, supported by detailed local market knowledge and proactive advice throughout the process.

-

Valuations, rent reviews & lease renewals

Independent, RICS-regulated advice on valuations, rent reviews and lease renewals. informed by current market evidence across Worcestershire and the wider region.

-

Commercial Property Management

Hands-on property management designed to protect income, reduce risk and remove day-to-day burden, delivered by a responsive local team who know your property inside out.

-

Building Surveying & Project Consultancy

Clear, practical surveying advice to help you understand your obligations, manage risk and protect long-term value. Including schedules of condition, dilapidations and project consultancy.

About GJS Dillon

GJS Dillon is a Worcestershire-based commercial property consultancy and firm of Chartered Surveyors, known for our local market knowledge and proactive, personal approach.

We work closely with businesses, investors and organisations, building long-standing client relationships based on trust and results.

Operating across Worcestershire and the wider West Midlands, we support clients across Worcestershire and the wider West Midlands.

Our directors are Royal Institution of Chartered Surveyors (RICS) Registered and remain closely involved in every instruction. Supported by an experienced team committed to ongoing professional development, we pride ourselves on our clear advice and high professional standards.

How we work

Over the life of a commercial property, priorities change. We support clients through acquisition, occupation, management, review and disposal, offering practical advice that reflects how property decisions are made at each stage. Our joined-up approach helps reduce risk, save time and ensure decisions are made with the full picture and local market knowledge in mind.

-

You’re acquiring new premises, relocating, investing or developing and need to make informed decisions before committing.

Key support at this stage:

Sales, lettings & acquisitions

Valuations

Pre-acquisition building surveys

Project consultancy

-

You’re entering occupation and need clarity around condition, responsibilities and future obligations.

Key support at this stage:

Schedules of Condition

Lease advice

Rent agreements

Party wall advice (where applicable)

-

You’re in occupation or ownership and need to manage the property effectively over time.

Key support at this stage:

Property management

Planned preventative maintenance

Ongoing valuations and advice

-

You’re approaching a lease event or review point and need to assess value, options and next steps.

Key support at this stage:

Rent reviews

Lease renewals

Reinstatement cost assessments

Valuations

Strategic asset review

-

A tenant is leaving, or you’re exiting or selling a property and need to manage obligations and protect value.

Key support at this stage:

Dilapidations advice

Exit strategy planning

Sales and disposal

Final building surveys

Not sure where you sit in the lifecycle? That’s exactly where we can help.

Worcestershire Commercial Property Market Reports

Each year, we produce our own Worcestershire Commercial Property Market Report, providing a detailed analysis of current conditions and emerging trends across the county’s office and industrial markets.

Drawing on our on-the-ground activity, the report examines how Worcestershire is performing at both a local and regional level, with in-depth insight into key sub-markets including Bromsgrove, Malvern Hills, Redditch, Worcester, Wychavon and Wyre Forest and how these compare with the wider national economy.

Latest news & insights

Market updates, professional insights and practical guidance from the GJS Dillon team, alongside selected industry news relevant to owners, occupiers and investors.

Speak to our team

Tell us a little about your property or situation and a member of our team will be in touch to discuss how we can help.